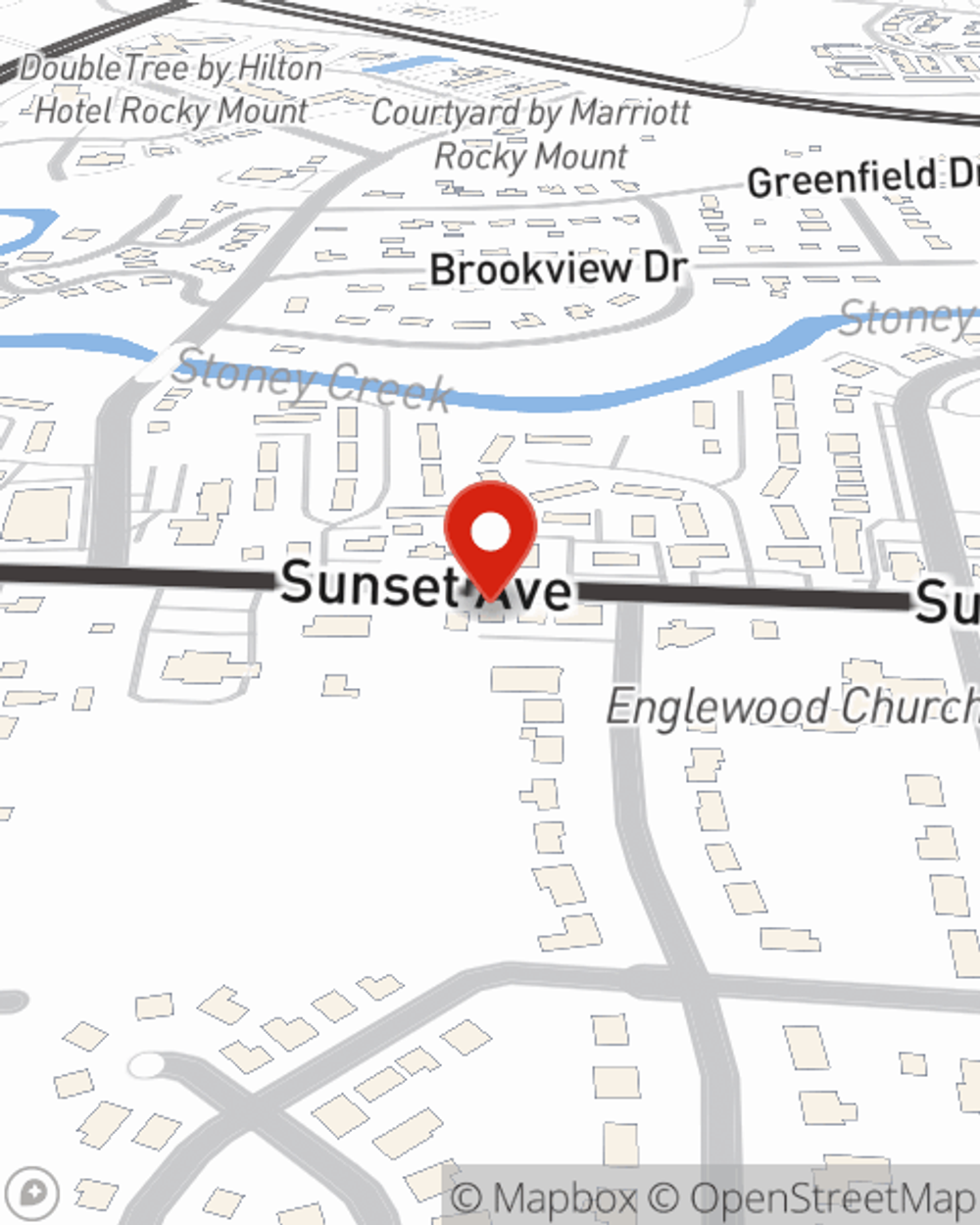

Business Insurance in and around Rocky Mount

Get your Rocky Mount business covered, right here!

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

Small business owners like you wear a lot of hats. From marketing guru to customer service rep, you do as much as possible each day to make your business a success. Are you a pet groomer, a home cleaning service or a lawn care service? Do you own a book store, a dance school or a tailoring service? Whatever you do, State Farm may have small business insurance to cover it.

Get your Rocky Mount business covered, right here!

Almost 100 years of helping small businesses

Protect Your Future With State Farm

Your business thrives off your tenacity commitment, and having great coverage with State Farm. While you support your customers and lead your employees, let State Farm do their part in supporting you with commercial auto policies, worker’s compensation and artisan and service contractors policies.

Let's chat about business! Call John Grimes today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

John Grimes

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.